If you want to establish a branch in Montenegro, you must know that it is an extension of the foreign parent company, without being a legal entity but with a permanent character. Our company registration experts in Montenegro can tell you more details about the characteristics of branch offices. You can rely on our company incorporation agents if you need help to set up a branch office in Montenegro.

You can rely on our company registration agents in Montenegro if you need help in setting up a branch office in this country.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Foreign country

|

|

Best used for |

Financial activities (banking, insurance) |

| Minimum share capital (YES/NO) | NO |

| Time frame for the incorporation (approx.) |

Approx. 4 weeks |

| Management (Local/Foreign) | Local or foreign (the parent company is not required to appoint a local director) |

| Legal representative required (YES/NO) |

NO |

| Local bank account (YES/NO) |

YES |

| Independence from the parent company | Fully dependent on the parent company |

| Liability of the parent company | Fully liable for the branch office' obligations |

| Corporate tax rate | 9% |

| Possibility of hiring local staff (YES/NO) | YES |

| Special requirements related to the trading name (YES/NO) | Yes, a branch must use the name of the parent company. |

|

Activities permitted |

Highly regulated activities are permitted. |

|

Restrictions (if any) |

Yes, a Montenegro branch cannot have other operations than the parent company’s. |

| Special licensing requirements (if any) | Possibly, depending on the sector it will operate in. |

| Local address required (YES/NO) |

Yes |

| Authority to be registered with |

Montenegrin Companies Registrar |

| Applicability of the corporate tax |

The corporate tax is levied on the Montenegro-sourced income. |

| Employment registration requirement (YES/NO) |

Yes, the branch must register as an employer and set up the payroll for this purpose. |

| Option to transfer employees from the headquarters (YES/NO) |

Yes, the foreign business can transfer employees to its branch in Montenegro. |

| VAT registration requirement (YES/NO) | Yes, a branch must obtain a VAT number. |

| Incorporation services availability (YES/NO) |

Yes, we can assist with the registration of a branch office in Montenegro. |

Table of Contents

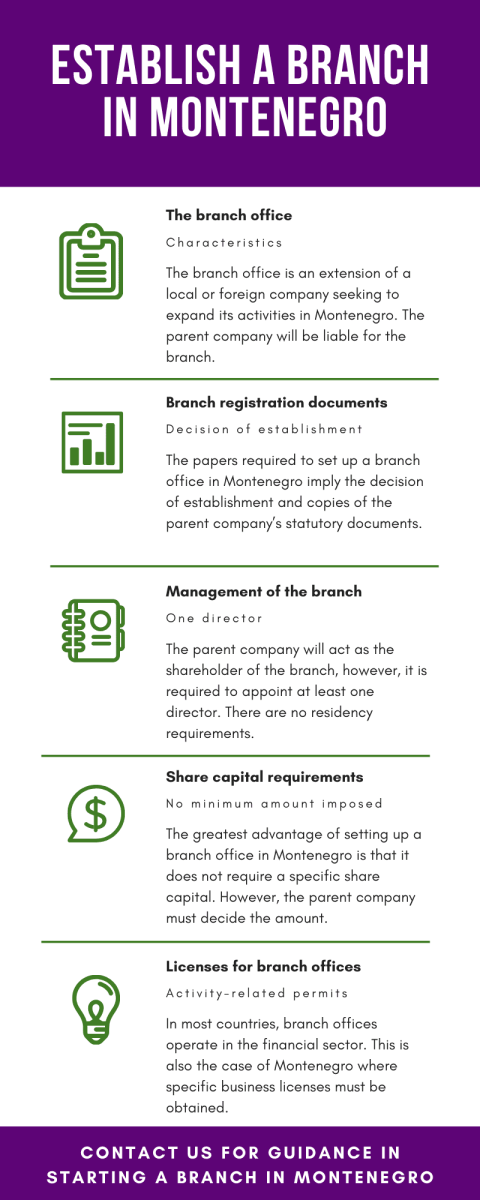

Characteristics of a Montenegro branch

As seen above, the branch office is an extension of another company, however, this is not the only characteristic of this business form. The branch office is defined by the Company Law of Montenegro and those who want to open such legal entities here must also consider the following aspects:

- the branch office must bear the same as the parent company, meaning it must operate under the same trading name;

- the are no share capital requirements for setting up a branch office in Montenegro, however, the amount of money for the operations must be established by the parent company;

- not only foreign companies can set up branch offices in Montenegro, but local companies can too;

- the Montenegro branch office must complete the same activities as the parent company, compared to the subsidiary company;

- from a taxation point of view, the branch office will be treated as a resident company only for the activities undertaken in Montenegro.

The name of the branch opened in Montenegro must contain the original name of the foreign company followed by the type of company and the termination “branch”.

If you want to open a company in Montenegro and need more information on the branch office as a way of doing business here, our local consultants can guide you.

If you want to form a shelf company in addition to opening a branch in Montenegro, get in touch with our company incorporation experts. They can help you acquire a shelf company, and also describe to you all the related details about the regulations of this specific company form.

We invite you to read about the steps for opening a branch in Montenegro in the infographic below:

Requirements for opening a branch office in Montenegro in 2024

The branch office is a simple business form, the requirements for setting it up being simpler than in the case of another business form, including that of a subsidiary company.

A branch office requires at least one shareholder which will be represented by the parent company. It also requires one director, a role which can also be taken by the parent company. There are no requirements for the shareholder or director to be Montenegro residents. In the case of foreign companies establishing branch offices in Montenegro in 2024, a representative who can act on behalf of the parent company in the relation with the Trade Register in Montenegro must be appointed.

Our Montenegro company formation advisors can inform foreign investors about all the requirements related to setting up a branch office. We can also assist with EORI registration procedures in Montenegro. Furthermore, if you want to relocate to Montenegro by applying for its citizenship by investment, you can avail services of our agents in this matter also. To assist you in obtaining citizenship by investment, our agents can give you information.

The registration of a branch in Montenegro

Before starting to operate business, a branch must be registered no longer than 30 days after the decision of establishment in the Central Registry of the Commercial Court of Montenegro with the following information and documents: the name and the address of the branch, the performed activities, the name and type of business of the foreign company, an authenticated copy of the memorandum of association of the foreign company (along with the Serbian authorized translation), the certificate of registration and an extract from the foreign register to prove the existence of the company in that country, the name and details of the foreign company’s representatives, the name and details of the resident person of Montenegro authorized to act in the name of the branch, the balance sheet and the profit and loss statements of the foreign company.

Any changes in the status of the branch or the foreign company must be announced no longer than 20 days. The liquidation of the parent company must be registered immediately in the Register along with the name of the liquidators or the liquidation procedure. Closing the branch is another action that must be registered in the Central Registry.

As a result of registration, the branch opened in Montenegro in 2024 will receive in maximum four working days the tax identification number, the registration certificate, the value added tax number and the customs authorization. The entire registration process of a branch office can be handled fast and easy by our team of Montenegro company formation specialists.

Furthermore, if you are unable to purchase a real office in Montenegro, you can also have a virtual office.

Steps for registering a branch office in Montenegro in 2024

The registration of a branch office in Montenegro implies the same steps as when incorporating a domestic company. These steps imply:

- – preparing the incorporation documents which consist in drafting and notarizing the parent company’s and branch office’s statutory documents;

- – paying the registration and the publication fees with the Companies Register in Montenegro;

- – filing the application form with the Trade Register in order to obtain the Tax Identification Number (TIN);

- – applying for the company seal and registering with the tax authorities for social security purposes;

- – obtaining the necessary licenses for operating with the relevant authorities in Montenegro.

It should be noted that the parent company’s Articles of Association must be translated in Montenegrin when submitted with the Trade Register for the creation of a branch office.

You can rely on our consultants if you want to open a Montenegro company.

Foreign citizens can also relocate here under the Montenegro citizenship by investment scheme.

Other requirements for establishing a branch office in Montenegro

If the branch will hire personnel, the next step after registration is submitting a list with the employees at the Health and Pension Funds and at the Tax Administration counter.

The last step is notifying the municipal and inspection authority in charge with economic affairs.

Members of EU may have special benefits in opening a branch in Montenegro. For example, the Stabilization and Association Agreement signed with the members of EU gives the right to the members to establish branches with the same right in Montenegro and with the right to acquire, use and rent real estate here.

An overall skeleton of a branch office in Montenegro

Here is an overall description of a branch office in Montenegro. This information can help you make a final decision if you want to establish a branch office in Montenegro or not. It takes almost 4 weeks to establish a branch office in Montenegro. If you are interested to open a branch in this country, you can get in touch with our company formation experts. They can provide you with comprehensive guidance and practical assistance to help you set up a branch office in Montenegro efficiently:

- – It takes almost 4 weeks to establish a branch in Montenegro;

- – A bank account for a branch can be opened in maximum 4 weeks;

- – A branch office in Montenegro has unlimited legal liability;

- – This entity is wholly foreign-owned;

- – The minimum share capital to set up a branch in Montenegro is EUR 1;

- – An annual tax return is required for the branch office;

- – A tax registration certificate is required for branch offices;

- – To open a branch office in Montenegro, no resident director is required;

- – No requirement of resident shareholder for a branch;

- – Montenegro resident company secretary is not required;

- – Corporate shareholders are allowed;

- – Corporate directors are allowed;

- – Annual financial statements are not required;

- – A statutory audit is not required for the branch office;

- – A branch office is regulated by the Chamber of Economy;

- – A branch office in Montenegro is allowed to issue sale invoices;

- – It is permitted for a branch office to sign contracts in this country;

- – It is allowed to import or export goods;

- – A branch can also rent office space in Montenegro;

- – It is also permitted to buy property in Montenegro;

- – Branch offices in Montenegro can own equity in other local companies.

If you are getting the services of our company incorporation consultants in Montenegro, you do not need to travel here. Our experts can perform the tasks here on your behalf. If you still have any questions regarding establishing a branch office in Montenegro, you can interact with our agents. They will answer your concerns in detail and also assist you to set up a branch in Montenegro.

Additionally, our Montenegrin team members offer online incorporation. If you require any of your corporate structures to be created online, they can assist. Our Montenegro company incorporation agents can provide you with thorough guidance in this area.

Taxation of branches in Montenegro

From a taxation point of view, the branch office will be taxed only on the income generated in Montenegro. Considering Montenegro has one of the lowest corporate tax rates in Europe, of 9%, branches will benefit from it.

With respect to the reporting requirements, the branch office is not subject to such obligations, however, the parent company is required to file audited accounts with the Montenegrin tax authorities, the Department of Public Revenues. The branch office is required to file annual tax returns. Montenegro has a relatively low cost of living and doing business compared to many other European countries. This could be beneficial for businesses that are looking to expand while keeping costs low.

Another advantage of setting up a branch office in Montenegro in 2024 is that this type of company can benefit from the country’s double taxation agreements. Furthermore, if you are a non-European Union national, then you can have access to the European market by setting up a branch in this country. Montenegro is a candidate for EU accession, which means that it is working towards meeting the requirements for joining the EU. By opening a branch office in Montenegro in 2024, you could potentially gain access to the EU market, which could be a significant benefit if you are currently not based in the EU.

If you need more information on the taxation of branches in this country, we kindly invite you to discuss with our company formation agents in Montenegro. You can also rely on us for accounting services.

If you want to apply for residence in Montenegro, you are welcome to consult with our agents. They can help you with your residency application and documentation.

Rules for permanent establishment of branch in Montenegro

A permanent establishment (PE) is a location where a non-resident conducts business in Montenegro. The tax laws of Montenegro have fundamental PE regulations that, for the most part, adhere to the recommendations given in the OECD Model Tax Treaty. When a non-resident has one of the following in Montenegro—a place of management, a branch office, an office, a factory, a workshop, a mine, an oil or gas site, a stone pit, or any other location where natural resources are exploited—permanent establishment (PE) is assumed to exist.

A branch is seen as a permanent establishment (PE) in Montenegro. Non-residents who conduct business in Montenegro through a PE are subject to progressive taxation on their revenue from Montenegro at the following rates:

- – For profits up to 100,000 euros, the tax rate is fixed at 9%;

- – For profits between 100,000 and 1,500,000 euros, the tax is fixed at 9,000 euros + 12% of the profit over 100,000 euros;

- – For profits above 1,500,000 euros, the tax is fixed at 177,000 euros + 15% of the profit over 1,500,000 euros.

These are the rates of progressive taxation paid by those non-residents who conduct business in Montenegro through permanent establishment (PE). If you have a permanent establishment branch office in Montenegro, you are required to comply with this taxation accordingly. You are also welcome to get in touch with our company incorporation consultants if you have any questions. They can provide you with detailed guidance in this regard.

Here is also a short video version of our article:

Why open a branch in Montenegro?

The branch office is one of the easiest ways of starting a company in Montenegro, implying low business registration costs and one of the fastest incorporation procedures. From a taxation point of view, Montenegro offers one of the lowest corporate taxes in Europe which extends to branch offices.

Foreign companies seeking to expand their operations in 2024 without going through too many procedures can decide for a branch office in Montenegro.

At the level of 2024, the Montenegrin branch office remains one of the most sought business forms among foreign enterprises seeking to continue their activities.

In its Global Economic Prospects report, which was released earlier in January, the World Bank raised its 2025 GDP growth forecast for Montenegro from 3.1% to 3.2%, or 0.2%. Montenegro’s GDP growth by the end of 2023 was predicted by the World Bank to be 4.8%, 1.4% points higher than the June forecast.

The 2024 state budget, which estimates a fiscal deficit equal to 3.1% of the anticipated gross domestic product (GDP), was also adopted by the Montenegrin parliament. The budget calls for revenues of 2.717 billion euros ($2.978 billion), which is 12.2% more than what is anticipated in 2023. The estimated amount spent is 2.952 billion euros, an increase of 11.9% over 2023. According to the Parliament, the economy of Montenegro is predicted to grow by 3.8% in 2024.

Please contact our experts in company formation in Montenegro if you are interested in extending your business in this country. We will analyse your request and we will find the best business solution according to your needs.