Foreign investors who come to Montenegro have several business forms they can select form when deciding to open a company. Among these, the private limited liability company or D.O.O (Društvo s ograničenom odgovornošću) is preferred by the majority. This is also the most employed business form by local investors who have companies in Montenegro.

Below, our company formation specialists in Montenegro explain the requirements related to opening a D.O.O. We can assist investors who want to register D.O.O companies in Montenegro with the purpose of operating in various industries. In case you are interested in starting a business in Ireland, we recommend our partners – LawyersIreland.eu.

| Quick Facts | |

|---|---|

| Best used for |

Business structures regulated by local investors |

|

Minimum capital to open a D.O.O in Montenegro |

Minimum 1 Euro |

|

Minimum number of shareholders |

Minimum number of shareholders is 1 |

| Shareholder liability |

Equal to the amount of initial capital he/she contributed |

| Residency requirements for foreign investors | No |

| Full foreign ownership permitted (Yes/No) |

Yes |

| Company name requirement |

To open a D.O.O in Montenegro, choose a unique name for your business that is not already in use |

| Registered office requirement |

The registered address must be the primary location of the company; If a company operates out of more than one location, the management office must be established at the registered address. |

| Main registration documents to open a D.O.O in Montenegro | articles of association; a list of the founders and board members with complete information; the proof of payment of the registration cost; the company name ,address for correspondence, and headquarters |

|

Registration requirements to open a D.O.O in Montenegro |

Mandatory registration with Central Registry of Business Entities (CBRE) in Montenegro |

| Licenses and permits | Yes, to be applied for after registration |

| Annual filing | Yes |

| Corporate income tax | 9% |

| Other taxes for companies | Social security contributions, environmental charges, stamp tax, payroll tax, property transfer tax, etc. |

| Tax incentives | For the first eight years, certain businesses operating in underdeveloped regions in Montenegro are exempt from corporate profit taxes. There is a €200,000 cap on the exemption. |

Table of Contents

What is a D.O.O in Montenegro?

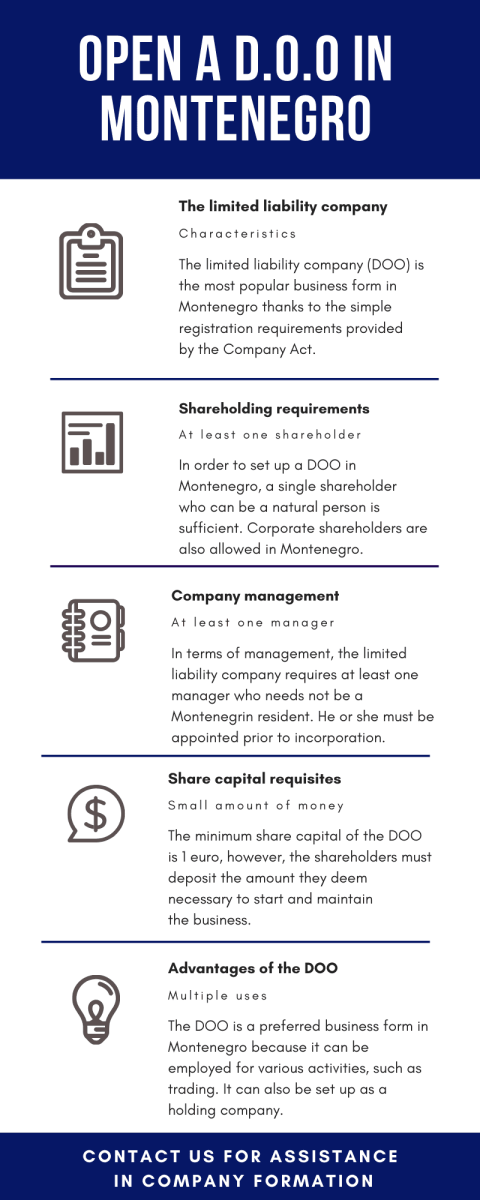

With the smallest share capital requested (only 1 Euro), the D.O.O represents the limited liability company in Montenegro. This type of company is the most common form of business in Montenegro. At least one shareholder is necessary for registration. The liability in the company of the shareholder is equal to its contribution at the initial capital.

In case you need assistance when opening a limited company in another country, for example in Thailand, we can put you in contact with our Asian partners – ThaiCompanyFormation.com.

The maximum number of shareholders in a D.O.O mustn’t exceed 30. The shares are not freely transferable to the public. The company’s management may be assured by a Board of Directors. If a Board of Directors is elected it may appoint a general manager to action in its name.

You can read about the creation of a DOO in Montenegro in the infographic below:

Requirements for opening a D.O.O. in Montenegro in 2024

The establishment of a private limited liability company in Montenegro is subject to several requirements imposed by the Company Law. Among these, we mention the following:

- the company must have a registered address in Montenegro (virtual office services are available with our agents);

- at least one shareholder who can be a natural person or legal entity, a Montenegro resident or non-resident is required;

- at least one manager who is not required to be a Montenegro resident must be appointed;

- the company will be registered based on the Articles of Association which must be filed with the Trade Register;

- as any local company, a bank account must be opened with a local bank before registering for taxes with the Tax Authority (the share capital will be deposited here).

Once the company is registered, the necessary business licenses must be obtained. The D.O.O. must also register for taxation with the Montenegro Tax Administration. If the company will be involved in trading activities, a VAT number is also mandatory.

Our Montenegro company formation advisors can explain all the requirements related to setting up a D.O.O. We can also handle the preparation of the documents which need to be filed with the Companies Register for quick incorporation. You can also rely on us for EORI registration services in Montenegro.

>> Our website was created by Clientpedia, a web design company based in London. We definitely recommend this professional team of web designers and online marketing experts.

Legal address requirements for a D.O.O. in Montenegro

In order to be considered a domestic company, the private limited liability company must have a legal address in a Montenegrin city, according to the provisions of the Company Law. There are no specific requirements as to where this address should be located or if it must be an office building, an industrial site or any of this kind, which is why foreign investors setting up companies here under this business form can choose a virtual office service at the beginning of their operations. No matter the choice, the application form filed upon company registration must contain the full address. If the property is a rental, the rental or lease agreement must also be appended to the application.

The registered address must be stipulated in the company’s Articles of Association and must be reported with the Companies House. Moreover, any change in the legal address must be reported to the Companies Register alongside other alterations brought to the company’s structure. Furthermore, a D.O.O is also not required to submit annual financial statements.

If you want to open a company in Montenegro and need an address, we can provide you with tailored virtual office services in large cities in the country. You can also rely on us for support for any other incorporation matters. Furthermore, in case you need other types of services, for example immigration services in Switzerland or in Ireland, we can put you in contact with our partners.

Shareholders in a limited liability company in Montenegro

The D.O.O. is a flexible business form and it must have at least one shareholder who can be a natural person or another company. Also, there are no restrictions in terms of foreign ownership, meaning that the Montenegrin private limited liability company can be entirely owned by foreign shareholders.

When setting up a private limited liability company in Montenegro, the names of the shareholders must be stipulated in full in the Articles of Association. The shareholding structure with the number and class of shares must also be written in its statutory documents. From a shareholding point of view, the shareholders will obtain shares in the company based on their contribution to the capital. The contribution must be paid in full upon the issuance of the shares. The shareholders are required to have at least one annual general meeting (AGM) where all important decisions about the continuance of the business are made.

The shareholding structure of the D.O.O. in Montenegro can be denominated in cash or kind, however, non-monetary contributions must be appraised by certified independent specialists.

As mentioned above, the minimum share capital of the LLC is the equivalent of 1 euro, according to the law, however, the shareholders will decide the amount of money they need to start and operate the business. Based on this amount, the shares will be issued, and each shareholder will decide the amount to contribute with to the capital.

Our Montenegro company formation advisors can offer more information on the shareholding requirements imposed when opening a D.O.O.

We can also help you open a company under the Montenegro citizenship by investment scheme.

Appointing company officers in a D.O.O. in Montenegro

The management structure of the Montenegro D.O.O. is quite simple, as it requires at least one director who can be one of the shareholders. There are no requirements related to the residency of director, however, it should be noted that when a foreign manager is appointed, he or she will need a work and residence permit in Montenegro. Also, the director must be hired by the company.

Company directors are appointed and removed by the shareholders.

If you have any questions about the management and corporate governance in a private limited liability company, feel free to discuss with our local consultants.

Corporate bank account opening

As any other local company, the D.O.O. must open a bank account with a local financial institution before the company registration procedure begins. This is a mandatory requirement, as the share capital must be deposited prior to the incorporation with the Trade Registrar which requires a bank statement indicating the deposit of the capital.

What is the company registration procedure for a D.O.O in Montenegro in 2024?

Registering with the Central Register of the Commercial Court of Montenegro requires a few documents:

- – the articles of association;

- – the company structure;

- – a list with the founders and the board Members;

- – data regarding these members (names, date of birth, place of birth, place of residence);

- – the company name and address of correspondence and headquarter;

- – name of the executive manager;

- – the names of the persons responsible with the company representative;

- – the proof of payment of the registration fee.

After submitting the correct documents, a Certificate of Registration is issued as evidence. Also, the registration announcement is published in the Official Gazette.

Any change that might interfere must be reported immediately to the Central Register of the Commercial Court (no longer than 7 days from the decision). The amendment becomes valid only after the registration in the Central Registry.

Annual financial statements are also required. Our company formation experts in Montenegro can give you more details about these financial statements.

Converting a limited liability company into a joint stock company

A limited liability company may be transformed into a joint stock company if certain criteria are accomplished: the minimum share capital is 25,000 Euro paid in full, a decision is taken by the general meeting of the shareholders and the amendments are registered at the Central Registry. In these types of situations it is recommended to ask for the help of our experts in company registration in Montenegro, who have handled company conversions before and can ease this process for you. In case you would like to start a LLC in another country, for example Moldova, our experts can put you in touch with their partners who can help you set up a SRL in Moldova.

The uses of a Montenegro D.O.O.

One of the reasons for setting up a D.O.O. in Montenegro is because it can be used for various purposes. Among these, we mention the following:

- – trading activities – the D.O.O. can complete activities in any industry in Montenegro;

- – holding structure – the D.O.O. can be used as a holding company for holding or controlling shares in other companies;

- – subsidiary company – the D.O.O. can be used by foreign companies seeking to have a presence in Montenegro;

- – shelf company – most ready-made companies are registered as private limited liability companies.

The D.O.O. is one of the most versatile types of companies which can be established in Montenegro because of its many uses. Considering the D.O.O. is subject to a few incorporation requirements and a simple and fast company registration procedure, it represents a suitable option for investors seeking to open SMEs in Montenegro (small and medium-sized enterprises).

Taxation of the D.O.O. in Montenegro

One of the most important advantages of the private limited liability company in Montenegro in 2024 is taxation. Montenegro has a business-friendly environment, with a relatively low tax rate and streamlined procedures for starting and operating a business. As a domestic company, the D.O.O. will be subject to the corporate income tax on its worldwide income in Montenegro. The country has one of the lowest corporate tax rates in Europe of 9%.

Furthermore, Montenegro has established free trade agreements with other countries in the region, which could make it easier to do business with those countries. To learn about those countries with which Montenegro has agreements in 2024, get in touch with our company formation experts.

It is also good to know that foreign investors owning shares in a Montenegro D.O.O. can benefit from the country’s double tax treaties which will enable them to obtain further tax deductions in their home countries.

As any other company in Montenegro, a D.O.O. is also subject to other taxes, among which the VAT which is levied at a standard rate of 21%. Other lower rates apply depending on the goods or services sold.

Our company registration consultants in Montenegro can offer more information on the taxes which need to be paid by D.O.O. companies here. We can also handle various taxation matters with the help of our in-house accounting department.

Accounting requirements for a Montenegro D.O.O.

Just like any other business, a company operating as a D.O.O. is required to respect the accounting regulations imposed by the tax authorities in Montenegro. As such, the company will be subject to an annual audit and annual tax filing requirements; however, it needs not file annual financial statements. The accounting of a private limited liability company can be completed in accordance with the national or international accounting practice.

If you need accounting services for your company in Montenegro, you can rely on our specialists who can help with personalized services, including tax minimization solutions.

Why set up a D.O.O. in Montenegro?

At the level of 2024, the D.O.O. has many advantages, which is why many foreign investors choose to operate in Montenegro under this business form. Apart from the tax benefits, the D.O.O. is very versatile and can be used for various purposes, which is why it is suitable for completing various activities here.

When it comes to investing in Montenegro, it is very useful to know that foreign direct investments (FDIs) here have increased substantially in the past few years, according to the following statistics:

- Foreign Direct Investment (FDI) in Montenegro rose by 85.2 USD million in September 2023 as opposed to 160.5 USD million in the same quarter the previous year;

- according to Montenegro’s most recent reports, the country’s current account deficit in March 2023 was 278.9 USD million;

- in March 2023, the Nominal GDP of the country was recorded as 1.3 USD billion;

- in September 2023, Montenegro Direct Investment Abroad saw a 26.5 USD million expansion;

- in September 2023 the country registered a decline in its foreign portfolio investment of USD 6.3 million.

At the level of 2024, the Montenegro D.O.O. is one of the best business forms for starting a business in this country. It can be employed for various activities and for those who want to obtain citizenship by investment here, it can be used for developing operations required under the program.

If you decide use the D.O.O. for starting a company in Montenegro in 2024, our specialists in company formation can offer updated information on the requirements.

If you want to open a company in Montenegro under the form of a D.O.O., our local consultants can help you. You can also watch our video:

How to liquidate a limited liability company in Montenegro

The liquidation of the limited liability company in Montenegro is made after a general meeting of shareholder’s decision or after a Court decision (in case of bankruptcy or if the law is broken). A liquidator must be appointed during the General Meeting, to carry out the liquidation process. The decision must be sent to the Central Registry and published in the Official Gazette.

After all the company’s debts have been paid, and no creditor is raising another claim, the rest of the remaining assets can be divided between the shareholders; the ones that had invested more have the priority.

In case you would like to open a limited liability company, our team of specialists in company formation in Montenegro is at your disposal. To set up such a company, you do not need to travel here from your home country. Contact us now for a personalized offer.

Russian and German investors interested in company formation services, will be put in contact with our partners: Firmengründung in Montenegro and Региситрация компаний Черногорье.